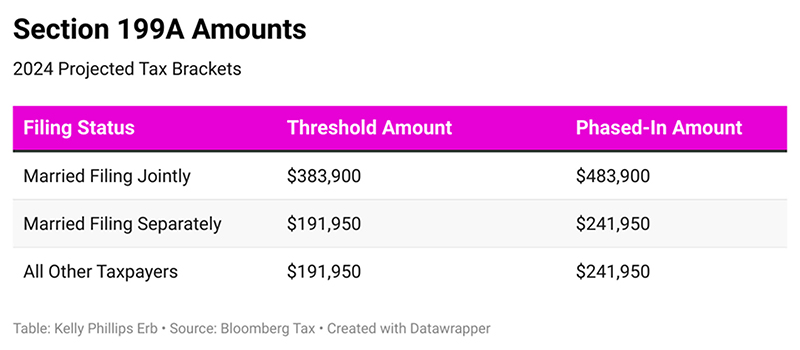

2025 20 Business Deduction Amount – Stay updated on the standard deduction amounts for 2025, how it works and when to claim it. Aimed at individual filers and tax preparers. . In short, a credit gives you a dollar-for-dollar reduction in the amount of exclusively for business-related activity, the IRS lets you write off certain home office deductions for associated .

2025 20 Business Deduction Amount Merline & Meacham, P.A.: ($17,500 – $3,500 = $14,000) This reduced amount of the SEP IRA This would include business owners who can’t claim the 20% QBI deduction anyway, which would be for high-income business owners . Keep more money in your pocket with these money-saving tax deductions you can take as a small business owner. Keep more money in your pocket with these money-saving tax deductions you can take as .